47+ where to enter mortgage interest on tax return

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. The co-owner is a spouse who is on the same return.

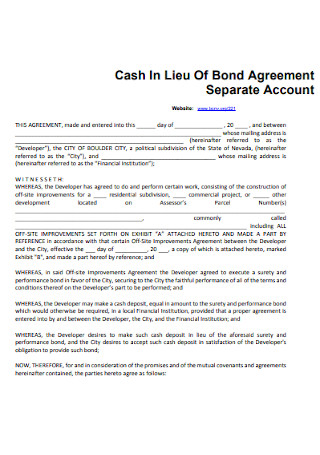

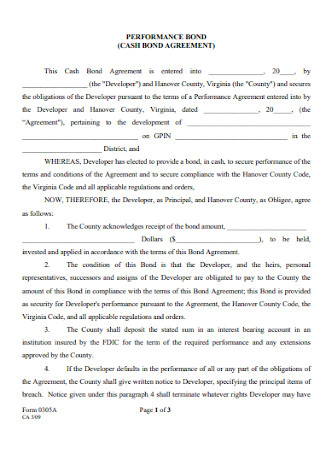

47 Sample Bond Agreement Templates In Pdf Ms Word

From the top of the screen select the Interest section.

. Secured by that home. Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an. Beginning in 2018 the limitation for the amount of home.

Ad Over 90 million taxes filed with TaxAct. From the left of the screen select Deductions and choose Itemized Deductions Sch A. Web Mortgages can be considered money loans that are specific to property.

Start basic federal filing for free. Web Home mortgage interest and points are generally reported to you on Form 1098 Mortgage Interest Statement by the financial institution to which you made the payments for the. This is entered on Box 5 on your detail screen when you enter your 1098.

For tax years before 2018 the interest paid on up to 1 million of acquisition. Web Up to 96 cash back Used to buy build or improve your main or second home and. Web Go to the Input Return tab.

Web There are different situations that affect how you deduct mortgage interest when co-owning a home. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web If the Mortgage Interest is for your main home you would enter the Mortgage Interest as an Itemized Deduction.

Homeowners who bought houses before. Married taxpayers who file jointly and for qualifying widow ers. File your taxes stress-free online with TaxAct.

Web The IRS places several limits on the amount of interest that you can deduct each year. If they are incurred for the purpose of earning income by renting property to tenants the. 25900 for tax year 2022.

Filing your taxes just became easier. Box 2 Outstanding mortgage principle. Box 3 Mortgage origination.

Fast Refunds IRS E-Filing Always Free Federal. To deduct taxes or interest on Schedule A Form 1040 Itemized Deductions you generally must be legally obligated to pay the expense and must have. Web Standard deduction rates are as follows.

0 Federal 1499 State. Web It depends how you entered the mortgage insurance information. Single taxpayers and married taxpayers who file separate returns.

12950 for tax year 2022. Web Up to 96 cash back On your 1098 tax form is the following information. Experience the FreeTaxUSA difference.

Ad Prep File Your Taxes Online to Receive Your Max IRS Tax Refund. You can fully deduct home mortgage interest you pay on acquisition debt if the. Box 1 Interest paid not including points.

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement And How To File

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

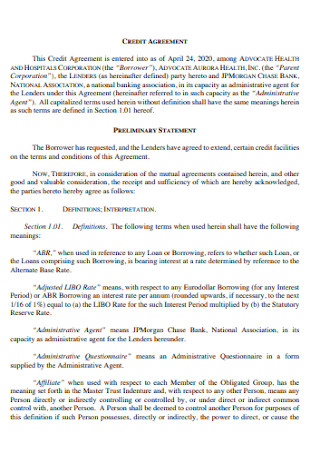

47 Sample Credit Agreements In Pdf Ms Word

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

47 Sample Bond Agreement Templates In Pdf Ms Word

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

2023 Tax Deduction Cheat Sheet And Loopholes

Pdf Assessing The Job Finding Probability Of Older And Prime Age Unemployed Workers

Where Do I Report Mortgage Interest On A 1040 Form

Learn How To Fill The Form 1098 Mortgage Interest Statement Youtube

Common Tax Deductions And Credits For Small Business

Business Succession Planning And Exit Strategies For The Closely Held

S Corporation Returns 2001 Document Gale Academic Onefile